Mietshäusersyndikat is a federation of quasi-inalienable housing commons in Germany that was organized in 1987 and is today widely known. html ![]() .

In 2013, when this article was published (html

.

In 2013, when this article was published (html ![]() ), Mietshäusersyndikat consisted of 50 housing projects connected to each other. By 2015, this number had risen to 95, and by 2017, 127 housing commons were associated with Mietshäusersyndikat and more than a dozen additional initiatives were interested in joining.

), Mietshäusersyndikat consisted of 50 housing projects connected to each other. By 2015, this number had risen to 95, and by 2017, 127 housing commons were associated with Mietshäusersyndikat and more than a dozen additional initiatives were interested in joining.

# Aspirational Goals The syndicat aspires to help house projects lasting for generations, and the houses to stay a commons and not being reprivatized.

xxxxx

To newcomers, the housing syndicate appears like a hodgepodge of very different rental housing projects scattered irregularly across Germany. They range from a housing project for senior women; a large apartment building with single parents; to a converted former military barracks housing more than 200 people. However, all Mietshäusersyndikat projects share two important common features:

# 1) Each is quasi-inalienable commons property.

Mietshäusersyndikat deliberately attempts to decommodify housing by making it quasi-inalienable -- i.e., very difficult to sell on the market. The syndicate is organized as a GmbH -- a limited liability business entity -- with voting rights vested with only two entities, the syndicate and the particular housing project. The syndicate voting rights are restricted to very fundamental decisions such as whether to buy or sell real estate, and amendments to the organizing statutes. Everything else is completely self-organized and peer governed by each housing project.

If there is interest in selling a property that has been held in common, there are only two votes in any final decision -- one vote from the respective housing association and the other vote from the syndicate. In essence, this gives the syndicate veto power over any decision by a housing association to sell its building, but it also enforces open deliberation. The structure provides an important check on the apartment owners (the housing projects) who may wish to sell and thereby reap a personal windfall from an appreciation of the building's market value. The voting structure helps prevent the cooperative housing as cooperative in the face of market pressures to privatize the economic value and disband.

This voting structure is an intriguing legal twist that serves to Relationalize Property by keeping valuable buildings as collectively owned and managed systems. The system also serves to Protect & Extend Value Sovereignty within the housing commons as it strives to protect the housing project from speculators, banks and having to rely on market-transactions.

# 2) Each project is managed through solidarity funding.

All Mietshäusersyndikat housing projects Pool & Mutualize. They get services from the syndicate according to their needs, and contribute the money for common needs -- publications and materials, consulting, legal fees, startup funding -- to the Mietshäusersyndikat. This contribution is called a "solidarity transfer." It starts at a sum of 0,10€ per square meter/per month, and rises based on a housing project's net income.

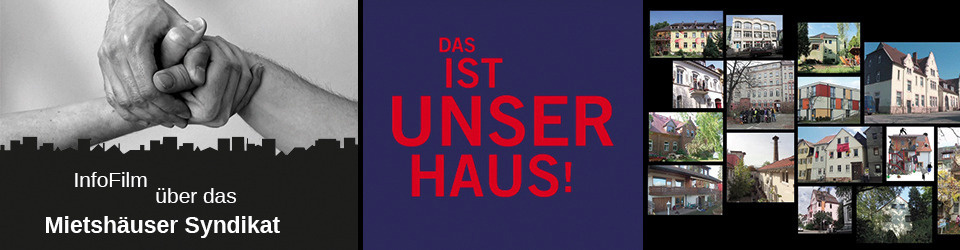

Photos for documentary in German "Das ist unser Haus", 2016.

source ![]()

In a typical condominium, there are high upfront capital costs for investors and high profits later. In contrast, Mietshäusersyndikat properties generate no profit. Surplus revenues are used for solidarity transfers to new associations, i.e. those projects that are starting to invest and wish to join the syndicate.

This transfer from older to newer projects helps the network grow and helps guarantee affordable rents forever. It is important to note that residents in Mietshäusersyndikat projects always pay rents - even if their individual housing project is already debt-free - because they don't only steward their respective apartment buildings, but the whole federation.

One of the Mietshäusersyndikat housing commons.

source ![]()

# How are they housing projects generally financed? Each project is financed by a mix of its residents' own capital, including peer-to-peer credits from member to member. A project's self-raised capital plus peer-to-peer credit raised from people connected to the project, can cover 25-50% of the purchasing and/or construction/remodeling costs. A second source of funds is external capital: real-estate credits from banks like GLS that have a socio-ecological mission, public banks (Sparkassen), and cooperative banks (Volksbanken).

Lieber 1000 Freund_innen im Rücken als die Bank im Nacken...!

Member-credit holders are not considered shareholders. There are no (cooperative) shares, just as there is no obligatory capital contribution to the federation. In case the credits cannot be paid back, the money is lost, but the people involved would not stay in debt with credit givers. Mietshäusersyndicat therefore encourages its members to support several other members instead of giving money to only one project. Interest for direct loans among members (cooperative lending among members} are fixed and go up to 2% per annum, but there are no equity shares in case the value of the real estate increases. This financial arrangement has been dubbed "capital neutralization” by Mathias Neuling.

This unusual system is possible because, as Gunter Kramp says:

"There are no shareholders who would be interested in increasing the value of the [Mietshäusersyndikat] real estate or selling it."

# Why do people give credits?

People do so mainly because the support the idea to decommodify the housing market. But also because they can rely on 100% transparency, local, ethical and ecologic investment, no speculation on the increase of value, no fees or administrative expenses for investors as well as trust in the network and the syndicat. For instance: seldomly a project fails and a credit cannot be given back, this is published on the federation's website.

Credit givers can also work with flexible conditions: a capped interest rate, duration and cancellation period can be freely agreed upon. The principle at work here is Cap & Mutualize.

# State poses limits Mietshäusersyndikat is only entitled under German law to give subsidiary credits as a legal requirement. Otherwise it would be considered an "illegal banking business."

# See also

France, Le CLIP (html ![]() )

Netherlands, VrijCoop (html

)

Netherlands, VrijCoop (html ![]() )

Woningbouwvereniging Soweto, housing project in Amsterdam, Netherlands, (html

)

Woningbouwvereniging Soweto, housing project in Amsterdam, Netherlands, (html ![]() )

Verein zur Förderung selbstverwalteter & solidarischer Lebens- und Wohnformen habiTAT, Austria, (html

)

Verein zur Förderung selbstverwalteter & solidarischer Lebens- und Wohnformen habiTAT, Austria, (html ![]() )

)

# Sources

Gunter Kramp, Community Land Trust and Urban Commons at Solikon, September 11, 2015.

Stefan Rost (2013). Das Mietshäuser Syndikat html ![]() Mietshäusersyndikat website html

Mietshäusersyndikat website html ![]()